Let’s be honest: figuring out the Rakez licence cost for 2024 can feel like trying to read a contract in a language you barely speak. You’ve probably seen headlines shouting “low fees” and then wonder, “what’s really hiding in the fine print?” We get it—your budget is tight, your timeline is short, and you need clear numbers before you sign anything.

In 2024 Rakez has streamlined its fee structure, but there are still three main buckets you’ll run into: the initial registration fee, the annual renewal charge, and any activity‑specific surcharges. The registration fee sits around AED 7,500 for most business activities, while the renewal is roughly AED 5,000 per year. If you add a flexi‑desk or a warehouse, expect an extra AED 2,000‑3,000 depending on size.

Take Sara, an e‑commerce startup founder from the UK. She needed a quick‑launch licence to import goods and sell them online. When she first looked at the Rakez portal, the headline price was AED 7,500, but the total first‑year outlay—including a mandatory flexi‑desk at AED 2,500 and a one‑time admin charge of AED 1,200—ended up at AED 11,200. Knowing that upfront helped her secure a modest loan and avoid nasty surprises later.

Here’s a quick checklist you can copy into your spreadsheet: • Registration fee ≈ AED 7,500 • Annual renewal ≈ AED 5,000 • Flexi‑desk (if needed) ≈ AED 2,000‑3,000 • Activity surcharge (e.g., trading, consultancy) ≈ AED 1,000‑2,000 • Miscellaneous admin fees ≈ AED 1,200. Add a 10 % contingency buffer for currency shifts or unexpected paperwork.

A practical tip we’ve seen work wonders: line‑up your flexi‑desk or physical office before you submit the licence application. It smooths the approval process and often trims the renewal fee by a few hundred dirhams. If you’re unsure which office option fits your cash flow, our guide on how to open a company in Dubai free zone walks you through the decision‑making steps and cost comparisons.

Actionable next steps: 1️⃣ List your core activity and check Rakez’s activity‑based surcharge table. 2️⃣ Calculate the total first‑year cost using the checklist above. 3️⃣ Set aside a contingency fund (10 %). 4️⃣ Book your flexi‑desk or warehouse space before filing the licence. 5️⃣ Submit the application with all documents ready, and you’ll usually hear back within 7‑10 business days.

Bottom line: the Rakez licence cost in 2024 isn’t a mystery once you break it into these bite‑size pieces. Armed with the numbers, you can budget confidently, negotiate with investors, and focus on growing your business instead of sweating over hidden fees. Ready to take the next step? Let’s get you started.

TL;DR

Understanding the rakez licence cost 2024 means breaking down the registration fee, renewal charge, activity surcharges and optional flexi‑desk expenses so you can budget confidently and avoid hidden surprises. Use our checklist to calculate total first‑year outlay, add a 10 % contingency, secure a desk before filing, and move forward with your UAE free‑zone launch.

Step 1: Understanding the Rakez Licence Structure

When you first land on the Rakez portal, the numbers can feel a bit like a jigsaw puzzle – registration, renewal, activity surcharges, flexi‑desk fees. It’s easy to stare at the headline AED 7,500 and wonder what else is hiding behind the scenes.

Let’s break it down the way we’d explain it over a coffee. First, there’s the registration fee. This is the one‑off amount you pay to get the licence issued. In 2024 it sits around AED 7,500 for most standard activities, but some niche categories (like aviation or heavy‑equipment trading) can push it a little higher.

Next up is the annual renewal charge. Think of it as a subscription you keep paying to stay in the free‑zone ecosystem. It’s roughly AED 5,000 a year, and it covers the basic administrative upkeep of your licence.

Now, the part that trips many newcomers: activity‑specific surcharges. Rakez tailors fees to the type of business you run. A consulting‑focused licence might add AED 1,000, whereas a trading licence could be AED 1,800. The key is to check the activity table early so you don’t get a surprise when the renewal invoice lands.

And then there’s the flexi‑desk requirement. Rakez mandates a physical address, even if you’re operating virtually. A shared desk or virtual office usually costs between AED 2,000‑3,000 per year. If you’re already planning a warehouse or a larger office, that cost can be bundled, but the minimum flexi‑desk fee still applies.

So, how does this all add up? Picture a tech‑startup founder in Berlin. He needs a consulting licence, a flexi‑desk, and the standard admin charge of AED 1,200. His first‑year outlay looks like this:

- Registration fee: AED 7,500

- Renewal (first year covered by registration): AED 0

- Activity surcharge (consulting): AED 1,000

- Flexi‑desk: AED 2,500

- Admin fee: AED 1,200

Total: AED 12,200. Knowing that number up front lets him budget for a modest loan and avoid scrambling for cash later.

One tip we’ve seen work wonders: lock in your flexi‑desk before you submit the licence application. The Rakez system flags the address during the initial review, and having it confirmed speeds up approval by a few days.

Another practical step is to double‑check whether your chosen activity falls into a “premium” category that carries extra surcharges. A quick glance at the Understanding flexi desk meaning in Dubai free zone guide can save you from an unexpected AED 1,500 hit.

While you’re crunching numbers, remember that the licence cost isn’t the only expense. You’ll also need to think about corporate bank accounts, accounting software, and maybe a bit of IT security. That’s where a partner like SRS Networks can help you set up a secure infrastructure without breaking the bank.

And don’t forget the printed side of your business. Custom invoices, labels, and business forms are essential for a professional look. JiffyPrintOnline offers affordable, high‑quality printing services that fit nicely into a startup budget.

Here’s a quick checklist you can paste into your spreadsheet:

- Registration fee – AED 7,500 (baseline)

- Activity surcharge – check Rakez table

- Flexi‑desk – AED 2,000‑3,000

- Admin fees – AED 1,200

- Contingency buffer – add 10 % for currency shifts

Finally, keep a simple spreadsheet that tallies these line items month by month. When the renewal notice arrives, you’ll already know the exact amount, and you can plan cash flow without scrambling.

Step 2: Mandatory Fees and One‑Time Charges

When you finally sit down with the fee table in front of you, the first thing that trips most founders up is the mix of recurring charges and one‑off items. It feels like you’re buying a car and suddenly being asked for a spare tire, insurance, and a GPS upgrade you didn’t know existed. Let’s break it down so you can see exactly what you’re paying for and when.

What counts as a mandatory fee?

Rakez requires a few non‑negotiable line items before you even get a licence number. These are baked into the “registration” stage and you can’t skip them.

- Registration fee – AED 7,500 (one‑time, covers the legal paperwork and issuance of the licence).

- Activity surcharge – varies by business type (e.g., trading = AED 1,500, consultancy = AED 1,000, manufacturing = AED 2,200).

- Mandatory flexi‑desk or virtual office – AED 2,000‑3,000 depending on size; even if you plan to work from home, Rakez insists on a physical address.

- Administration charge – AED 1,200 for document processing, notarisation, and portal fees.

All of these show up on the first invoice you receive after the portal validates your application.

One‑time charges you might overlook

Beyond the core mandatory fees, there are a handful of one‑off costs that pop up once you decide on a physical space or a specific licence tier.

- Lease agreement registration – if you rent a warehouse or office, you’ll pay AED 500‑1,000 to register the lease with Rakez.

- Initial security deposit – usually 10 % of the annual renewal fee, held as a guarantee against violations.

- Business activity amendment fee – AED 300 if you need to tweak your activity description before the licence is issued.

These are easy to miss because they’re listed in the fine print of the application portal.

Real‑world example: Sara’s e‑commerce launch

Sara, a UK‑based founder, thought her start‑up cost would be under AED 9,000. After pulling the numbers she discovered:

- Registration fee: AED 7,500

- Flexi‑desk: AED 2,500

- Admin charge: AED 1,200

- Activity surcharge (trading): AED 1,500

Total first‑year outlay: AED 12,700. Because she added a 10 % contingency (AED 1,270) she avoided a cash‑flow crunch when the admin charge arrived a week later.

Actionable checklist – calculate your mandatory fees

Grab a spreadsheet and fill in these columns:

Item Estimated Cost (AED) Registration fee 7,500 Activity surcharge — (pick based on your activity) Flexi‑desk/Virtual office — (2,000‑3,000) Admin processing 1,200 Lease registration (if any) — (500‑1,000) Security deposit (10 %) — (10 % of renewal fee) TOTAL — (sum) Contingency (10 %) — (10 % of total)

Once you have the numbers, compare them against your startup budget. If the total exceeds your cash reserve, look at two quick levers:

- Swap a physical desk for a virtual office – saves up to AED 1,000.

- Choose a lower‑cost activity surcharge if your business can start with a narrower scope.

Tips from the trenches

— Ask for a detailed fee breakdown from the Rakez sales rep before you sign anything. They’ll send you a PDF that matches the portal numbers.

— Bundle the flexi‑desk with a coworking membership – many providers offer a 6‑month discount that brings the cost down to AED 1,800.

— Watch the renewal calendar. Late renewal incurs AED 50 per day, and those penalties add up fast.

Why the “one‑time” label matters

If you treat the registration fee as a recurring expense, you’ll over‑budget for years to come. Remember: it’s a sunk cost that you only pay once, but the admin charge recurs if you need to amend your licence later.

That’s why we always recommend budgeting a separate “one‑off” line in your financial model – it keeps your cash‑flow forecast realistic.

Next step: lock in your mandatory fees

Now that you know what to expect, here’s what to do today:

- List your core activity and match it to the Rakez surcharge table.

- Choose between a flexi‑desk or virtual office and get a quote.

- Plug the numbers into the checklist above and add a 10 % contingency.

- Contact a Rakez representative to request an official fee breakdown.

- Secure the desk or virtual office before you submit the licence application.

Doing these steps removes the guesswork and ensures the moment you click “Submit,” you already know the exact amount you’ll owe.

Need more detail on how a flexi‑desk works and when a virtual office makes sense? Check out our guide on understanding flexi desk meaning in Dubai free zones. It walks you through pricing, eligibility, and the paperwork you’ll need.

Step 3: Variable Costs – Office Space, Employees, and Services

Let’s get practical: once your registration and one‑time fees are out of the way, the monthly and operational costs are where your real cash flow lives.

These are the line items that change as you scale, hire people, add services or expand into storage. You can control some, compromise on others, but you need to forecast them accurately.

Office space — flexi, virtual, or a physical unit?

Do you really need a physical office on day one?

Short answer: usually not. Many founders start on a flexi‑desk or virtual office to save AED 1,000–3,000 per year versus a full office.

If you plan to store goods, ship stock or show clients product samples, budget for a warehouse or storage unit — those costs jump quickly and often come with lease registration fees and security deposits.

For warehouse decisions, compare the per‑month rent, utilities, and the one‑time fit‑out. Think about racking, insurance and inbound/outbound logistics — each adds to your monthly burn.

If you’re unsure about whether a virtual address will pass for your licence application, read our in‑depth note on Virtual Office Eligibility UAE Free Zone: Complete Guide for Business Setup which explains zone rules and eligibility.

Employees — the predictable and the variable costs

Salaries are the largest recurring variable cost for most free‑zone startups.

Calculate salary + visa + medical + Emirates ID + employer social/insurance contributions per employee. For many roles, plan on at least AED 8,000–12,000 total cost of employment for mid‑level hires; lower for junior, higher for experienced talent.

Think in three buckets: core team (you can’t cut), contractors (flexible) and occasional freelancers (on demand).

Hiring full‑time gives stability but raises fixed monthly burn. Freelancers reduce fixed cost, but factor in procurement and quality control time.

Actionable payroll checklist

Create a simple row per hire in your model: base salary | visa & medical (one‑time/year) | monthly benefits | expected probation period costs.

Freeze hiring if your cash runway dips below 6 months — simple rule but it saves founders from panic.

Services: IT, accounting, marketing, and compliance

These are often underestimated. Cloud subscriptions, accounting packages, PRO and legal services, and cybersecurity are recurring and scale with users or transactions.

Example: a basic accounting + PRO retainer can be AED 1,500–3,500/month; a professional payroll/HR service is another AED 1,000+/month depending on team size.

Audit and tax advisory spikes happen yearly — build those peaks into your quarterly cash forecast.

Step‑by‑step: how to budget this month

1) List every variable line you expect in the next 12 months.

2) Assign conservative high/likely/low estimates for each line.

3) Model three scenarios: lean, expected, aggressive growth.

4) Add a contingency (10–15%) for FX moves, licence amendments, and unexpected admin fees.

So, what should you do next?

Run this simple test: if your 12‑month model with hires and services leaves less than 6 months of runway, delay hires or switch to contractors until revenue climbs.

Small shifts in office type or outsourcing can buy you months of runway — and nothing matters more than runway when you’re starting up in 2024.

Step 4: Cost Comparison Across Popular Freezones

Alright, you’ve mapped out your hires and services, now it’s time to stare at the numbers that actually decide where you set up shop. The free‑zone you pick can add—or shave off—thousands of dirhams from your first‑year budget.

Does it feel overwhelming? Trust me, you’re not alone. The trick is to line up the big three: registration fee, annual renewal, and activity‑specific surcharge. Once you see them side by side, the decision becomes a lot clearer.

Why a side‑by‑side table helps

Our brains love visual comparison. A quick glance at a table tells you whether a zone is a “budget‑friendly starter” or a “premium‑level hub” without you having to add up rows of text.

So, here’s a snapshot of three of the most popular zones for startups in 2024.

| Freezone | Registration Fee (AED) | Annual Renewal (AED) | Activity Surcharge (AED) |

|---|---|---|---|

| RAKEZ | ≈ 7,500 | ≈ 5,000 | 1,000‑2,500 (depends on activity) |

| Dubai Internet City (DIC) | ≈ 9,000‑10,000 | ≈ 6,500‑7,500 | 1,200‑2,200 |

| Jebel Ali Free Zone (JAFZA) | ≈ 10,000‑12,000 | ≈ 7,000‑9,000 | 1,500‑2,800 |

Notice the spread? RAKEZ sits at the low‑end of the spectrum, which is why many bootstrapped founders gravitate there first.

But don’t let the lower price be the only factor. Think about the ecosystem you need. DIC, for example, clusters tech and media firms, giving you instant networking opportunities that can offset a slightly higher fee. JAFZA, on the other hand, is a logistics powerhouse – perfect if you need a warehouse or heavy‑goods import/export capability.

Real‑world feel: what entrepreneurs actually see

In our experience, a SaaS founder who chose RAKEZ saved roughly AED 3,000 on registration compared to DIC. That saved cash was redirected into a modest marketing push that generated the first 20 paying customers.

Conversely, a trading company that needed a large warehouse found JAFZA’s integrated storage facilities worth the extra AED 2,000‑3,000 annual renewal because the zone’s logistics partners offered discounted freight rates.

So the “cheapest” isn’t always the “best” – match the zone’s strengths to your business model.

How to run your own quick comparison

Grab a spreadsheet and copy the table above. Add a column for any extra line items you know you’ll need – like a flexi‑desk, visa package, or PRO service. Then apply a simple formula: Total Cost = Registration + Renewal + Surcharge + Extras + 10% Contingency. If the total pushes you past your runway threshold, you either need to renegotiate a desk, trim the activity scope, or consider a different zone.

Here’s a quick checklist:

- Identify your core activity (trading, consultancy, manufacturing, etc.).

- Pick the three zones you’re eyeing.

- Fill in the numbers from the table and add any zone‑specific fees (like JAFZA’s warehouse levy).

- Include a 10 % buffer for currency swings and surprise admin fees.

- Compare the final totals against your cash runway.

That simple exercise often reveals a hidden cost‑saver you hadn’t considered – like swapping a physical desk for a virtual one, which can shave AED 1,000‑2,000 off the annual renewal.

If you’re still unsure which zone aligns with your budget, our Minimum Share Capital for UAE Free Zone Company: Complete Guide breaks down the capital requirements that go hand‑in‑hand with licence fees, giving you a fuller picture of the financial commitment.

And for the data behind the RAKEZ numbers? We pulled them straight from the official RAKEZ blog post that walks through the cost breakdown of free‑zone versus mainland setups Rakez business‑set‑up cost comparison. It’s a solid reference if you want to double‑check the figures.

Bottom line: line up the three cost pillars, add any zone‑specific extras, and you’ll see exactly which freezone gives you the most runway for the money. Once you’ve done that, you can move forward with confidence, knowing you’ve squeezed every dirham out of the equation.

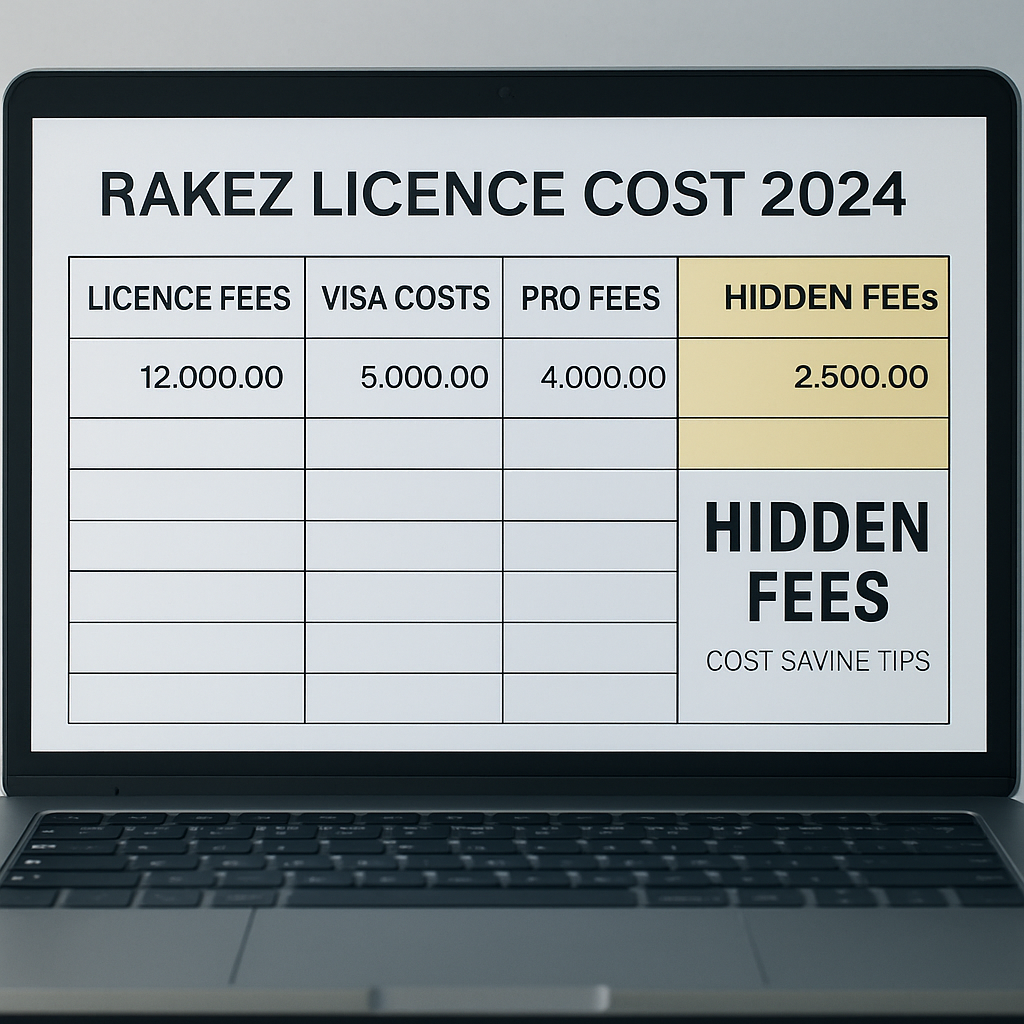

Step 5: Hidden Fees and Cost‑Saving Tips

Now that you’ve mapped the three big buckets, it’s time to shine a flashlight on the little things that can quietly blow your budget. Hidden fees feel like surprise guests at a party – you didn’t invite them, but they show up anyway.

Common hidden costs you might miss

• Visa quota surcharge. If you add more employees than the original quota, RAKEZ tacks on a per‑visa fee that can be AED 500‑800 each.

• PRO service renewals. Many founders think the PRO (Public Relations Officer) fee is a one‑off, but it’s usually billed annually and can climb to AED 1,200 if you need extra document clearance.

• Bank account activation fee. Some local banks charge a set‑up fee of AED 1,000‑2,000, plus a minimum balance that ties up cash you might have earmarked for marketing.

• Late‑payment penalties. A missed renewal day adds AED 50 per day, and the cost compounds fast if you’re juggling multiple licences.

Real‑world examples

Take Omar, a tech‑consultancy founder. He budgeted AED 13,500 for his first year, assuming the licence, desk, and visa fees covered everything. Two months after launch, a sudden need for a second visa added AED 600, and his PRO provider raised the annual fee by AED 300 because he switched to a faster document‑processing tier. Those extra AED 900 pushed his runway down to just three months.

On the flip side, Maya, a small‑scale e‑commerce seller, noticed the bank she’d chosen required a AED 2,000 activation fee plus a AED 5,000 minimum balance. She switched to a fintech‑friendly bank that offered a zero‑fee account and a lower balance requirement, instantly freeing up AED 7,000 for inventory.

Actionable checklist to hunt hidden fees

1️⃣ Write down every line item you see on the official fee table.

2️⃣ Add a column for “potential extras” – visa quota, PRO, bank fees, late‑payment penalties.

3️⃣ Reach out to the RAKEZ help desk or a trusted consultant and ask for a detailed breakdown of each extra. Arnifi explains how renewal costs can mirror the initial licence fee, so you’ll know if you’re looking at a one‑time charge or a recurring one.

4️⃣ Plug the numbers into a simple spreadsheet and calculate a 10 % contingency on the total of “extras.”

5️⃣ Review the list with your accountant and flag anything that looks unusually high or unclear.

Cost‑saving hacks that actually work

• Bundle visas with a coworking package. Many coworking operators negotiate bulk visa quotas with RAKEZ, shaving AED 300‑400 per visa.

• Negotiate the PRO fee. If you have an in‑house admin person, you can often drop the PRO service entirely and handle document clearance yourself – just be sure you meet the legal requirement of a registered PRO.

• Pick a virtual office instead of a flexi‑desk. A virtual address can cost as low as AED 1,500 per year, versus AED 2,500 for a flexi‑desk, and it still satisfies the licence requirement.

• Pre‑pay renewal. RAKEZ sometimes offers a 5 % discount if you pay the renewal fee for two years up front. Calculate whether the cash outlay now beats the discount later.

• Audit your bank fees annually. Banking terms change; a quick call can reveal a newer, cheaper account that saves you thousands.

Step‑by‑step hidden‑fee audit

Step 1: Open a fresh tab and pull the official RAKEZ licence fee PDF.

Step 2: List every mandatory item (registration, renewal, activity surcharge, desk).

Step 3: Under “extras,” write visa‑related fees, PRO, bank, and penalty possibilities.

Step 4: Contact the RAKEZ customer service line and ask: “What are the fees if I increase my visa quota by two?” Write down the answer.

Step 5: Compare your total against your cash runway. If the gap is more than 15 %, look for the hacks above.

Doing this audit once a year keeps you from being blindsided when a renewal reminder pops up in your inbox.

Bottom line: hidden fees are avoidable if you treat them like any other line item – write them down, ask questions, and negotiate where you can. By the time you click “Submit” on your renewal, you’ll know exactly what you’re paying and why.

Conclusion

We’ve walked through every piece of the rakez licence cost 2024 puzzle, from the registration fee to the hidden extras that can sneak up on you.

If you pause and ask yourself, “What will really hit my cash runway?”, the answer is simple: list every line item, add a 10 % buffer, and double‑check the visa‑quota and PRO charges before you sign anything.

In our experience, entrepreneurs who treat these fees like a spreadsheet – ticking off each mandatory cost and flagging the ‘maybe’ items – walk away with a clearer budget and far fewer sleepless nights.

So, what’s the next move? Grab that checklist we built earlier, plug in your actual activity surcharge, lock in a flexi‑desk or virtual office that fits your cash flow, and send the final numbers to your accountant today.

Remember, the rakez licence cost 2024 isn’t a mystery once you break it down – it’s a tool you can use to negotiate, plan, and grow without surprise bills.

Need a quick sanity check? Use the simple formula: Total = Registration + Renewal + Surcharge + Desk + Extras + 10 % contingency. If the sum feels tighter than your runway, revisit the desk option or negotiate the PRO fee.

Ready to lock in your numbers and move forward? Our free‑zone toolkit at UAE Free Zone Finder can help you fine‑tune the budget and keep the paperwork on track – just a click away.

FAQ

What is the total rakez licence cost 2024 for a brand‑new startup?

In 2024 the base registration fee sits around AED 7,500. Add the annual renewal of roughly AED 5,000, plus the activity‑specific surcharge, which can be anywhere from AED 1,000 to AED 2,500 depending on what you’re doing. Then you have the mandatory flexi‑desk or virtual office, usually AED 2,000‑3,000. Throw in the one‑time admin charge of about AED 1,200 and you’re looking at a first‑year outlay of roughly AED 15,000‑16,000. If you pad it with a 10 % contingency, you’ll have a safe buffer for currency shifts or unexpected paperwork.

Are there any hidden fees I should watch out for?

Yes, a few sneaky line items often slip past first‑time founders. Visa‑quota surcharges pop up if you add more employees than the original quota – expect AED 500‑800 per extra visa. PRO services are usually billed annually, not just once, and can climb to AED 1,200. Some banks charge an activation fee and a minimum balance that ties up cash. Late‑payment penalties are AED 50 per day, so set calendar reminders. Write each of these down early and you’ll keep your cash runway intact.

How does the flexi‑desk fee affect my budget?

The flexi‑desk is a non‑negotiable requirement for most licences, but you have options. A full‑service desk can cost AED 2,500‑3,000 per year, while a virtual office drops that to around AED 1,500. If you’re comfortable handling mail remotely, the virtual address saves you up to AED 1,500. Just make sure the virtual office meets Rakez’s address verification rules, otherwise you’ll end up paying a replacement fee later.

Can I reduce the activity surcharge?

Activity surcharges are tied to the primary business activity you declare. If you can start with a narrower scope – say, consultancy (AED 1,000) instead of full‑blown trading (AED 1,500) – you’ll shave a few hundred dirhams off the first‑year cost. As your business evolves, you can apply for an activity amendment, but that costs an extra AED 300. So plan your core service carefully; a small initial concession can keep your budget lean.

What’s the renewal process and cost each year?

Renewal is a straightforward online submission on the Rakez portal. You’ll pay the annual renewal fee of roughly AED 5,000 plus any activity‑specific surcharge that remains unchanged. The flexi‑desk or virtual office fee rolls over, so budget that again each year. If you miss the deadline, the system adds AED 50 per day, which adds up fast. Most entrepreneurs set a reminder a month before the expiry date and settle the payment early to avoid penalties.

Do I need a PRO service and how much does it cost?

A PRO (Public Relations Officer) is required to handle government paperwork and visa processing. Many startups outsource this for convenience; typical fees range from AED 800 to AED 1,200 annually, depending on the provider and the level of service. If you have a trustworthy in‑house admin person, you can register them as the PRO and eliminate the external cost, as long as they meet the legal qualifications.

What’s a good checklist to avoid surprise expenses?

Start with a simple spreadsheet. List every mandatory line item – registration, renewal, activity surcharge, flexi‑desk/virtual office, admin charge. Add columns for potential extras: visa‑quota fees, PRO fees, bank activation costs, and late‑payment penalties. Populate each with the most recent figures you can get from the Rakez portal or your consultant. Finally, add a 10 % contingency row. Review the sheet with your accountant before you sign any contract, and you’ll walk into the licence process with confidence.

Additional Resources

Feeling a bit overwhelmed after crunching all those numbers? You’re not alone – the rakez licence cost 2024 can feel like a maze of fees, deadlines, and fine print.

One quick way to keep everything straight is to bookmark a few go‑to pages that we update regularly. First, our free‑zone fee calculator lets you plug in your activity, desk choice, and visa quota, then spits out a total with a 10 % safety buffer. It’s a lifesaver when you’re juggling multiple scenarios.

Second, the Rakez portal’s “Fee Schedule” PDF is the official source for registration, renewal, and activity surcharge figures. Download it once and keep a copy in a folder next to your business plan – you’ll thank yourself when the next renewal reminder pops up.

Third, if you’re wondering how a flexi‑desk compares to a virtual office in real‑world terms, our comparison cheat sheet breaks down cost, paperwork, and compliance impact in a side‑by‑side table.

Finally, don’t underestimate the value of a simple checklist. Write down every mandatory line item, then add columns for “potential extras” like visa‑quota fees, PRO services, or bank activation costs. Review it with your accountant before you sign anything.

Got a lingering question? Drop us a line in the comments or hop onto the live chat on our site – we love turning confusion into clarity.